Contents:

If there are no https://g-markets.net/, it means that the sellers have overshadowed them. The chart above clearly shows that the shooting star pattern emerges as soon as the RSI reading is above 70, asserting overbought conditions. The pattern forms at an area of strong resistance indicate that the price is likely to edge lower from the bullish setup.

It is not limited to a particular instrument as it is a function of trader’s sentiments and price action. However, if the pattern appears near a resistance level or trend line, then the shooting star can add confirmation to the new bearish bias. This is because a single candle is not extremely crucial in the overall trend or market movement. In terms of the characteristics of the pattern – The shooting star reversal pattern has a long upper shadow, short lower shadow, and a small real body. As you can see in the example above, the MACD crossover did not happen in the exact price level of the shooting star candlestick.

GBP/USD Forecast: Overall Negative Outlook for the Pound – DailyForex.com

GBP/USD Forecast: Overall Negative Outlook for the Pound.

Posted: Tue, 14 Mar 2023 07:00:00 GMT [source]

Prices are always gyrating, so the sellers taking control for part of one period—like in a shooting star—may not end up being significant at all. The long upper shadow represents the buyers who bought during the day but are now in a losing position because the price dropped back to the open. Supplement your understanding of forex candlesticks with one of our free forex trading guides. If you are interested in trading using technical analysis, have a look at our reviews of our recommended brokers to learn which tools they offer. In the CSCO chart above, the market began the day testing to find where supply would enter the market.

How to Identify a Shooting Star Candlestick

The emergence of a more bearish candle after the shooting star candle asserts a change in momentum from bullish to bearish. Traders who opened short positions after the close of the confirmation candle ended up accruing significant pips as the price tanked significantly. Such a setup is often referred to as a failed bearish reversal, as bears are overpowered by bulls coming back into the market and pushing the prices higher. It is a bearish candlestick pattern characterized by a long upper shadow and a small real body. The pattern forms when a security price opens, advances significantly, but then retreats during the period only to close near the open again. Consequently, the open and close price points are close to one another.

Keep in mind that Australian dollar is going to continue to be noisy, as there are so many questions about China and the global economy. If we break below that level, it could open the door to even more negativity and result in a more vicious selloff. Fortunately, the buyers had eaten enough of their Wheaties for breakfast and still managed to close the session near the open. ThinkMarkets ensures high levels of client satisfaction with high client retention and conversion rates. Harness past market data to forecast price direction and anticipate market moves. No matter your experience level, download our free trading guides and develop your skills.

The Relative Strength Index is a vital momentum indicator that indicates levels where the market is overbought or oversold. Readings above 70 imply market overbought, while readings below 30 assert oversold conditions. Further your knowledge on candlesticks with a foundational piece on forex candlesticks. For example, waiting a day to see if prices continued falling or other chart indications such as a break of an upward trendline. Learn the exact chart patterns you need to know to find opportunities in the markets.

What is a Shooting Star Candlestick?

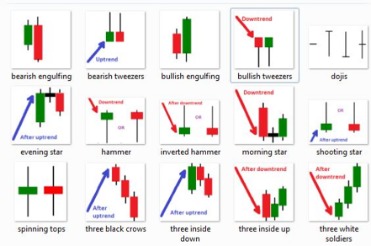

There is a long upper tail or upper shadow, a comparatively much shorter lower tail or shadow, and a noticeably short body with the price closing below the candle’s opening price. The shooting star pattern is just one of many signals of potential market reversals recognized in candlestick charting. Other reversal patterns include engulfing candles, the hanging man pattern, and doji candlestick formations. The bulls or buyers struggle to push prices higher as more bears or short sellers enter the market and place short positions. The high of the long shadow acts as a resistance level, above which bulls struggle to push prices higher as bears enter the market. Consequently, prices start to edge lower as bears appear to be winning the battle.

With these conditions met, we should go back to the shooting star formation for further analysis. We want the shooting star pattern to have either touched or penetrated the upper line of the bearish channel. If you look closely at the shooting star formation once again, you will notice that the upper wick did in fact penetrate the upper line of the bearish channel plotted. The stop loss on the trade will be set at the high of the price bar that breaks below the trendline. Essentially, that is the bar that acts as our entry confirmation signal. Finally, we will need a way to monitor the price action if it moves in our favor to the downside, and exit the trade when the weight of evidence is pointing to an upside reversal.

What Is A Candlestick Pattern?

Let’s now take a closer look at two typical scenarios wherein the shooting star formation is often seen. The first scenario is when the market is exhibiting a clear uptrend, and the second scenario is when the market is correcting to the upside within a larger downtrend. This is evident from the closing price within the shooting star, which occurs within the lower one third of the price range.

- https://g-markets.net/wp-content/uploads/2021/09/image-wZzqkX7g2OcQRKJU.jpeg

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth.jpg

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth-164×164.jpg

- https://g-markets.net/wp-content/uploads/2020/09/g-favicon.png

Therefore, we will always search for multiple confirmations, e.g. one could only sell a shooting star candlestick formation if the price reaches a resistance area at the same time. Also, it is very important to wait for the candlestick to be formed and not to sell a shooting star candlestick formation as long as the candlestick wasn’t closed yet. The shooting star reversal candlestick boasts a success rate of about 69% when predicting bearish reversals from an uptrend.

This means the trader is entering a short trade at a higher price and with a tighter stop loss reducing risk. As seen in the photo above, an inverted hammer takes place in a downtrend while a shooting star occurs after a series of bullish candles that bring the price action higher. An inverted hammer occurs at the bottom of the downtrend when the bears show the first signs of weakness and tiredness. Like a hammer, an inverted hammer is a bullish reversal pattern that signals the growing presence of the bulls in the equation.

Firstly, we can see within the magnified area near the top right of this image, a clearly defined forex shooting star candlestick. Remember, a valid shooting star candle pattern should meet a few important guidelines. Firstly, the upper wick within the shooting star should be quite noticeable and prominent in relation to the lower wick or shadow of the candle. As outlined earlier, a shooting star is a bearish reversal pattern which signals potential change in the price direction. The uptrend is nearing its end as the momentum is weakening, and the sellers are feeling more confident that they can force a reversal in price action.

If however the price begins to move in our favor following a short entry, then we will watch the price action closely as it trades within the bearish channel. The exit signal would be triggered upon the price touching the lower line of the bearish channel. Now that we have recognized a shooting star formation on the price chart, we need to confirm whether or not it occurs in the context of a rising market.

The forex shooting star version of the Shooting Star formation is the Inverted Hammer formation that occurs at bottoms. We risked 75 pips to gain 150 pips, which represents quite a good risk to reward ratio. Looking at the chart, we could drop to the 0.66 level, where we have seen support previously. The 0.67 level has been an area of resistance multiple times, and it’s likely to continue to be important. The only difference between them is whether you’re in a downtrend or uptrend. The Hammerand Hanging Man look exactly alike but have totally different meanings depending on past price action.

Trading academy Learn more about the leading Academy to career trader Program.

Different indicators and patterns, because multiple confirmations increase the probability of a successful trade tremendously. So without further ado, let’s dive right into the explanation of the shooting star candlestick pattern. In approximately the center of the chart, you can see a strong, sustained up move in GBP/USD. Several candlesticks show the currency pair moving sharply higher, but then a candlestick forms a shooting star pattern.

Shooting Star vs. Inverted Hammer

This shows the same buying pressure seen over the last several periods. As the day progresses, though, the sellers step in and push the price back down to near the open, erasing the gains for the day. This shows that buyers lost control by the close of the day, and the sellers may be taking over. If the price rises after a shooting star, the formation may have been a false signal or the candle is marking a potential resistance area around the price range of the candle. The candlestick has a long upper shadow that is at least twice the length of the real body. After an uptrend, the Shooting Star pattern can signal to traders that the uptrend might be over and that long positions could potentially be reduced or completely exited.

Find the approximate amount of currency units to buy or sell so you can control your maximum risk per position. In this article, we will show you the main elements of this pattern, how to spot it. Moreover, we will explain how you can trade it profitably and increase your odds of success. Depending on your comfort level and style of trading, you may choose one entry method over the other or choose some other variation altogether.

We’re also a community of traders that support each other on our daily trading journey. The Shooting Star is a bearish reversal signal, which means it indicates that the price has reached the top of its current uptrend and will fall soon. As a “Shooting Star”, it makes sense for the signal to occur high up after the price has gone up sky high. The take-profit level depends on your trading style and risk management. In this particular example, we placed a profit-taking order at the previous resistance. Given that the market had pushed through this resistance line, it is likely to come back to test it in the context of support once it corrects lower.

Just In: After a month, NSE removes Adani Enterprises from additional surveillance framework – Economic Times

Just In: After a month, NSE removes Adani Enterprises from additional surveillance framework.

Posted: Mon, 06 Mar 2023 08:00:00 GMT [source]

The shooting star chart pattern that emerges at the termination of the upside correction has been magnified for easier viewing. For this reason, a shooting star candlestick pattern is a very powerful formation. Its shape gives the pattern a lot of attention as the wick always sticks out from the rest of the price action. The difference is that the shooting star occurs at the top of an uptrend. The inverted hammer, on the other hand, is a bullish chart pattern that can be found at the bottom of a downtrend and signals that the price is likely to trend upward.